4 TFSA Investment Options You Should Know About

TFSAs aren’t just a place to store cash. They can be used to hold a number of different types of investments.

A 2015 Mackenzie Investments survey finds only 46% of Canadians know stocks and mutual funds can be put into a TFSA. That’s a pretty low number considering TFSAs have been available for nearly seven years.

Here’s a quick rundown of the investment options available.

High-interest savings

If you want to save but need access to your cash in case of an emergency, consider opening a TFSA savings account. Not only will you earn income on a tax-free basis, you’ll also have a guaranteed rate of return.

GICs

If you want a higher guaranteed rate of return, consider getting a GIC. Rates are locked in for a certain period of time and you won’t lose any money.

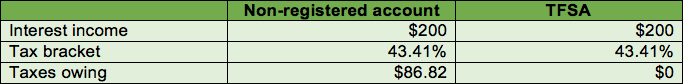

Let’s assume you have $10,000 and buy a one-year GIC with an interest rate of 2%. If you buy the GIC in a non-registered account, you live in Ontario, and pay a marginal tax rate of 43.41%, you’ll owe $86.82 in taxes when your GIC matures. If you hold a GIC in a TFSA, you won’t have to pay a cent.

Canadian stocks/mutual funds/ETFs

Putting stocks, mutual funds, and ETFs in a TFSA is a good way to shelter yourself from taxes when you have a capital gain.

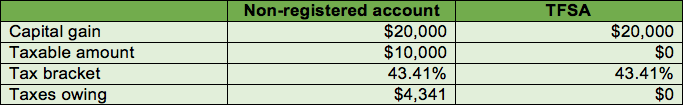

If your investment is in a non-registered account, you’ll have to pay tax on any capital gain. Let’s assume you had a capital gain of $20,000 and you pay a marginal tax rate of 43.41% in Ontario. Just half of the capital gain ($10,000) is taxable.

If your investment is held in a non-registered account, you’ll have to pay $4,341 in taxes. In a TFSA, you don’t have to pay any tax.

Foreign stocks/ETFs

If you invest in companies whose stocks are traded on exchanges outside of Canada, they can also be put into a TFSA. But if you like investing in American dividend-paying stocks, you will have to pay a withholding tax on the dividends. In an RRSP, you don’t have to pay the tax.

Let’s assume you own 100 shares of US-based XYZ Corp and it pays an annual dividend of $50. If you hold the shares in your TFSA, you’d have to pay a withholding tax of 15% (this rate is the same for everyone in Canada). So your income from dividends would be reduced to $42.50 a year if the stock is held in your TFSA compared to $50 a year if the stock is held in your RRSP. This is a rare occasion when income earned in a TFSA is subject to tax.

Using a TFSA is a great way to save and there are many options for you to choose from. The best part of all is your savings will grow tax-free!

Flickr: MoneyBlogNewz