Battle of the Mortgage Campaigns: RBC vs Laurentian

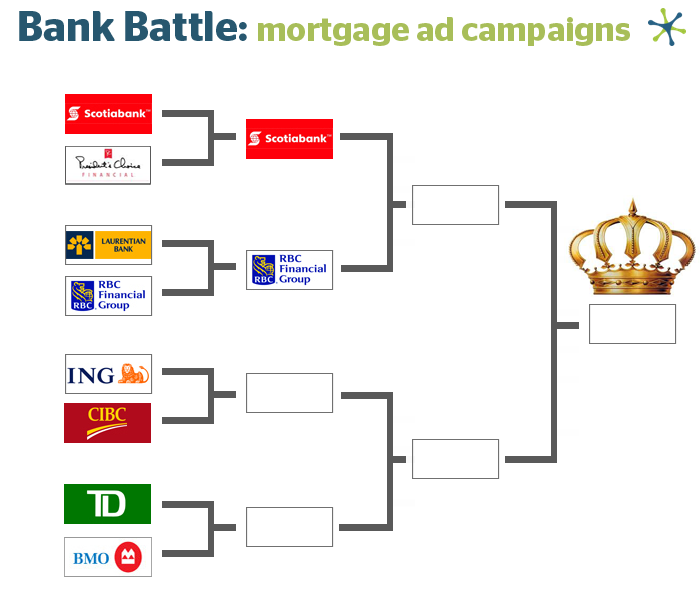

Welcome to Ratehub.ca’s newest Bank Battle Series. This time we will be pitting Canadian banks against each other, head-to-head, to determine mortgage campaign superiority.

The total amount of Canadian outstanding mortgage principal is approximately $860 billion, which doesn’t even account for Home Equity Lines of Credit (HELOCs). Even in the face of worrying global economics, Canadian mortgage credit is expected to grow by about $80 billion, or 7.8% in 2011, according to Will Dunning of CAAMP. With that much value in the mortgage industry, we will examine each bank’s effort to capitalize and gain market share favour. Here we go, with the second battle of Round 1 to earn our prestigious “Best Mortgage Campaign Award”.

Contenders

The Challenger in the blue corner: Laurentian Bank (LBC), based out of Montreal, Quebec.

The Challenger in the red corner: The Royal Bank of Canada (RBC), based out of Toronto, Ontario.

Video Campaigns

RBC Marketing Theme:

Laurentian Bank Marketing Theme:

“The Child in You”

Thoughts

Laurentian Bank’s commercial was very fun to watch. Although it took us a few seconds to “get it”, and when we did – a smile couldn’t help but crawl across our face. The ad was quite clever and had us intrigued from the get-go. What we found most interesting was the message that was conveyed: “Follow your instincts. Buying a house doesn’t have to be complicated with Laurentian Bank.” By simplifying the home buying process, mortgage acquisition becomes much more inviting.

RBC’s ad spot, although not as fun, was very well targeted and the only bank in this series that specifically directed their mortgage campaign towards new immigrants. Sadly, New to Canada Mortgages are part of the market that receives little to no-attention. RBC does a good job of making sure these first-time home buyers are aware that they have options as new immigrants. This is an extremely important target market when you factor in Canada’s great multi-cultural history which was built on immigration over the last century.

CURRENT MORTGAGE RATES:

We’ve witnessed two very impressive mortgage ad campaigns from both RBC and Laurentian Bank. Let’s take a look at how their current 5-year fixed rates and 5-year variable rates compare:

*Rates taken October 06,2011

Conclusion:

Toronto versus Montreal; where have we seen this before? Both banks offer the exact same 5-year variable and 5-year fixed rate. In terms of mortgage campaigns and mortgage rates, this was an extremely close bank battle. The decision really came down to the wire as we flipped back and forth. However, we found that RBC’s specific mortgage targeting trumped LBC’s creativity by the slightest of margins.

THE WINNER:

THE TOURNAMENT RECAP

See the last Mortgage Campaign Battle: PC Financial vs Scotiabank