Calculate the Mortgage Payment on an Average Home in Toronto

For anyone thinking of buying a home, it’s important to educate yourself on both your real estate market as well as how large of a mortgage you can afford to take on. In this series, we are going to look at the average home price in your city or province and walk you through the mortgage payment calculations with our mortgage calculator.

According to the Canadian Real Estate Association (CREA), the average home price in Toronto is $526,335. But what does that look like in terms of a monthly mortgage payment? Let’s look at a Toronto home that is priced close to the city’s average home price and run the numbers through our mortgage payment calculator.

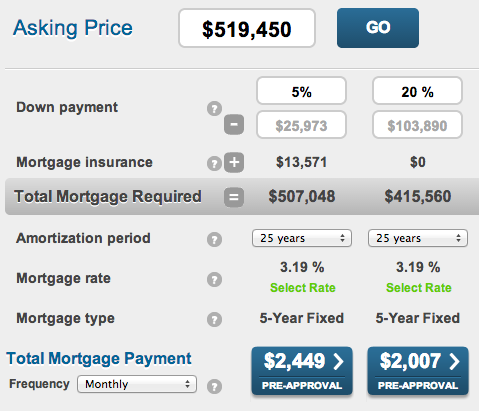

The house seen above is a detached two-storey, three-bedroom home located in the Rockcliffe-Smythe community of Toronto and is priced at $519,450. Using this example, we will compare the monthly mortgage payments that would result from both a 5% down payment and a 20% down payment. Note that both calculations use a 5-year fixed mortgage rate of 3.19% and an amortization period of 25 years. Use our amortization calculator if you want to get a sense of what your monthly mortgage payments would be under different amortization length scenarios.

With a 5% down payment:

A 5% down payment on a $519,450 home is $25,973. And while you would think that would bring your total mortgage amount down to the $400,000 range, anyone taking on a mortgage with less than a 20% down payment will also need to pay for CMHC insurance (mortgage default insurance). In this example, the CMHC insurance is $13,571 and is included in the total mortgage of $507,048. Assuming a 5-year fixed rate of 3.19%, your monthly mortgage payment would be $2,449.

With a 20% down payment:

A 20% down payment on a $519,450 home is $103,890. And because you made a down payment of 20% or more, you would not need to pay for CMHC insurance, so your total mortgage would be the purchase price minus your down payment ($519,450 – $103,890 = $415,560). Assuming you took on a 5-year fixed mortgage at 3.19%, your monthly mortgage payment would be $2,007.

Beyond your mortgage, there are a number of other closing costs to consider, such as the Ontario land transfer tax (LTT) and the Toronto land transfer tax (TLTT). For this example, your total LTTs combined would be $12,978. However, if you’re a first-time buyer in Toronto, you would be eligible for an LTT rebate of $5,725 bringing your total LTTs down to $7,253. Note that this is an additional closing cost you would need to save up and pay for on closing day.

Our calculator tells you what your monthly mortgage payment would be but you can choose from other payment options as well. Most lenders give you the ability to choose monthly, bi-weekly or accelerated bi-weekly payments, and others may even let you make weekly payments. You can read more about your mortgage payment options here.