Canadian Home Sizes: A Unique Perspective, Mortgage Aside

In a recent survey, Point2 Homes asked 29,000 people from nine countries about the sizes of their actual and ideal homes. The survey revealed that Canadians have the third-largest homes. Compared to the other surveyed countries, their expectations for ideal homes are quite reasonable, even when setting aside detailed mortgage concerns.

When looking at Canada, different regions have different mentalities when it comes to home sizes, but things average out overall. Well, except in some Canadian cities: Vancouver and Toronto.

42% of Canadians want larger homes

The surveyed countries were Canada, the United States, France, Germany, Australia, Spain, the United Kingdom, Brazil, and Mexico. In this group, Canadians are tied with the French when it comes to the percentage of respondents who think bigger is better (42%).

American respondents seem a bit more satisfied with their current home sizes—38% of them said a larger home would be ideal, four percentage points less than Canadian respondents.

At the other end of the spectrum, in Mexico, 66% of the answers stated that ideal homes should be larger than current residences. Respondents in Brazil and the U.K. think the same way, at 62%.

Of course, these percentages become even more relevant when you apply them to the average square footage of a home in each country. When you’re already living in a home of more than 1,700 square feet on average, it’s more likely you’ll be satisfied with the space you have.

Highest home size expectations

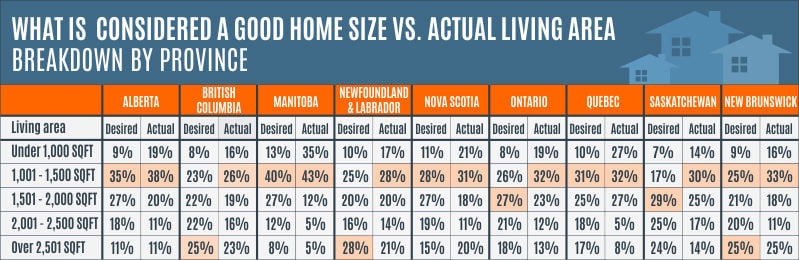

Although Canadians seem very levelheaded on average, the Point2 Homes survey shows some striking gaps between reality and expectation, when looking at individual provinces. Here’s an overview:

Take British Columbia, for example, where 26% of respondents live in homes between 1,000 and 1,500 square feet. On the other hand, 23% already enjoy homes of more than 2,500 square feet.

Perhaps it’s not surprising that 25% of respondents dream of such mansions themselves, even if the average home price in the province is $690,597.

Even after the recent cool down, the Vancouver real estate market is still the second most dynamic in Canada. In a crowded city where even a small home costs a fortune, dreams run hot, and bigger is clearly better from the respondents’ point of view.

The situation is different in Newfoundland and Labrador, where sales numbers are growing, but prices are staying low. Here, an average home costs $251,555—less than half the average price in B.C. For roughly the same money that people elsewhere in Canada put up for an average condo, Newfoundland and Labrador residents can get a large single-family detached home in St. John’s.

The same goes for New Brunswick, where the average home now costs $162,099. Keep in mind that federal mortgage rules state that the debt-to-income ratio should stay below 35% for a homebuyer to qualify. In New Brunswick, this means an annual income of $25,680—the lowest in Canada.

In Alberta, Manitoba, Nova Scotia, Quebec, and Saskatchewan, real homes and ideal home preferences are very similar. The largest numbers of respondents here both live in and desire homes of 1,001 to 1,500 square feet. The annual income needed to pay the mortgage on an average house hovers between $39,000 in Halifax and $66,549 in Calgary.

That leaves Ontario, where things are a bit more complicated. Across the province, 32% of respondents live in homes as large as 1,001 to 1,500 square feet, and 27% think an upgrade to the 1,501 to 2,000 square foot bracket would be ideal. Mississauga, Hamilton, and Ottawa show balance between reality and expectations, which can be interpreted as a greater degree of respondent satisfaction. However, the great pressure affecting the Toronto real estate market right now leads to some shocking differences there.

Largest gaps between reality and expectations

Another Point2 Homes study investigated the annual income needed to buy a house in 10 of Canada’s major cities. The debt-to-income ratio sheds new light on the great differences between various cities, even if the numbers tend to average out at a provincial level.

Toronto has the largest gap between actual and ideal home size in all of Canada, with 33% of respondents living in properties smaller than 1,000 square feet, and 28% wishing for homes larger than 2,500 square feet.

The percentage of respondents that live in small homes is the second highest in Canada—after Winnipeg’s 39%.

Still, considering that a professional needs to make upwards of $110,000 each year to qualify for a mortgage on an average-priced home in Toronto, it’s no surprise that so many residents live in small homes. Population density is also much higher here than in most other Canadian cities, which drives the condo market up as well.

In fact, the only other two cities where the numbers are similar to those in Toronto are Vancouver and Halifax. In Vancouver, 29% of respondents live in homes smaller than 1,000 square feet, and 32% think a home more than 2,500 square feet is ideal. The debt-to-income ratio for Vancouver requires an annual salary of almost $130,000 to afford a mortgage and stay under the 35% qualifying line—very close to the situation in Toronto.

Real estate in Halifax is more affordable, like in all the Atlantic provinces, which is likely why more people dream of larger houses. Here, most respondents live in homes between 1,001 and 1,500 square feet, but 30% think homes of more than 2,500 square feet are ideal.