Canadians Shy Away from 5-year GICs in Favour of Shorter Terms

When you have to commit to something, it’s almost always better to choose a shorter term. Why sign up for a two-year mobile plan when you can get pay as you go? Why sign a one-year lease on an apartment if you can get month-to-month? Why buy a five-year GIC when you can get the same rate on a two-year GIC?

It turns out it’s really expensive to buy that new iPhone outright and you won’t find a good landlord who doesn’t demand a one-year term. But there has been a trend in GICs in favour of shorter terms.

For those of you who are new to GICs, they’re an easy way to save money for a guaranteed rate of return, with a catch: Your money’s locked in for a specified term. GICs are sold in terms anywhere from 30 days to five years, and sometimes longer. Historically, as you commit to a longer term, you’ve been rewarded with a higher interest rate. A two-year GIC will pay more interest than a one-year GIC, and so on.

Recently however, that’s changed. Right now if you compare the best GIC rates on Ratehub.ca, you’ll notice the best-in-market GIC rates are the same for two-, three-, four-, and five-year GICs—all 2.75%. The trend has been attributed to uncertainty among banks as to what will happen with the economy. Unsure whether they’ll be able to re-invest their customers’ GIC money profitably a few years down the road, banks are discouraging people from locking in their money for more than two years.

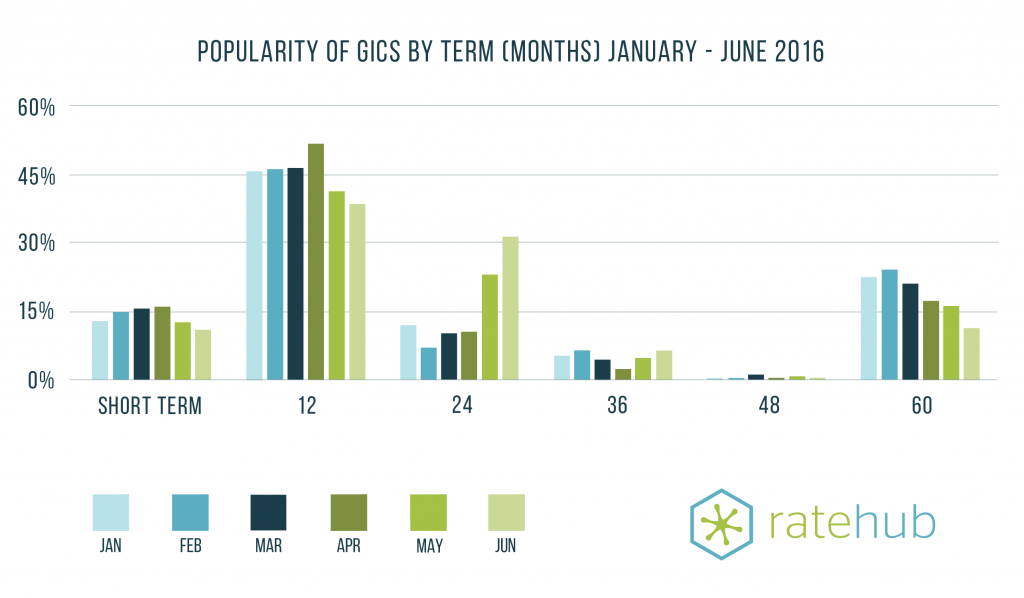

And as the incentives to sign up for a five-year GIC diminish, so too is the number of Ratehub.ca users opting for shorter GIC terms. Over the course of this year, we’ve seen a trend among our users away from five-year GIC rates, and toward two-year GIC rates. When looking at anonymous data that shows which GIC rates our users clicked on, we see the popularity of five-year GIC terms fell by more than half, from 24% of clicks in February to just 11% this month. Meanwhile the popularity of two-year GICs grown from a low of 7.5% of clicks in February to 31% of clicks in June.

The one-year GIC term is still the most popular among our users, but has fallen from a peak of 52% of all clicks in April, down to just 38% in June.

So what should you do now that you’re armed with this new knowledge?

- Compare GIC rates carefully. Think about your long-term savings goals and the reason you want to invest in a GIC. And don’t assume you’ll get a higher GIC rate just for choosing a longer term.

- If saving for the short-term, consider a high-interest savings account. Currently, the best savings account rate in Canada is 2.25% (compare that with the best one-year GIC rate at 2.05%). The only catch is your savings account rate could change at any time.

- Think about locking in for longer anyway. If you think GIC rates could come down—and you’re comfortable with the risk/commitment—you can still lock in the highest available GIC rate for five years.

Experts are warning us to settle in for a sustained low-interest rate environment, which is good news for your mortgage but not great for your low-risk investments. The benefit of GICs is they take the uncertainty out of investing. You know what the return will be for sure, and regardless of what happens in the market, you know your money will be secure.

The rates quoted in this article are accurate as of Jun. 28, 2016 but GIC rates change frequently. Use our comparison tool to see the best GIC rates in Canada as of right now.

Also read:

- Use Your TFSA or RRSP to Maximize GIC Returns

- Should You Put a Market-Linked GIC in Your RRSP?

- How to Build a GIC Ladder

Flickr: KMR Photography