First-time homebuyers eager to get into the market, but are they properly prepared?

Canadians overwhelmingly aspire to become first-time homebuyers, despite mounting challenges such as a rising interest rates and difficult qualification standards.

That’s according to a recent Ratehub.ca survey, which polled over 2,000 Canadians across the country.

Of those who currently don’t own a home, 71% said they plan to purchase a home in the future, even when facing rising interest rates and home prices, as well as qualification rule changes that have made it more difficult for first-time homebuyers to get into the housing market. 59% plan to purchase within the next two years.

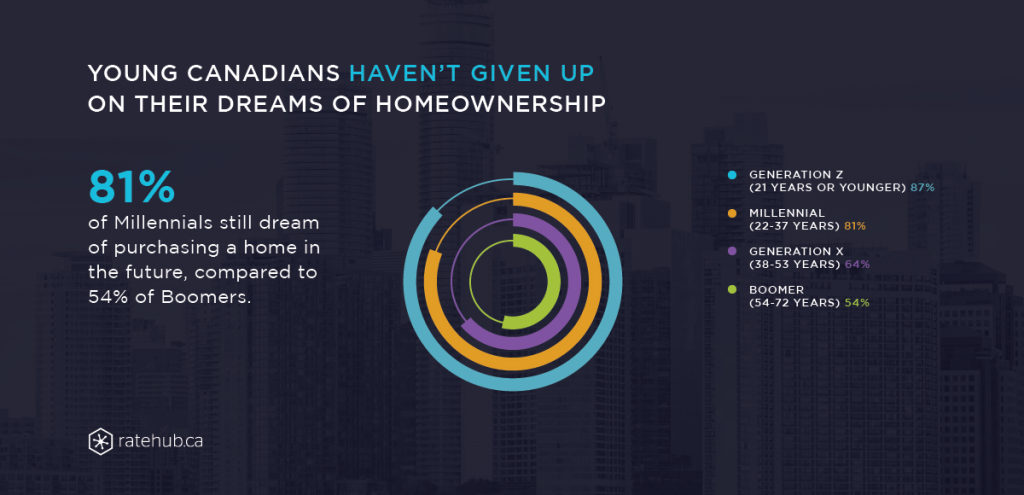

Young Canadians, in particular, see the appeal of home ownership; 81% of Millennials and 87% of Gen Z say they would like to buy a home.

One major driving factor for aspiring home owners is the belief that real estate is a good long-term investment.

Among survey respondents, 75% believe owning property is a good investment in general and 44% said it’s a better long-term investment than mutual funds, stocks, and GICs.

Compare today's top mortgage rates

Looking for a great mortgage rate? Check out the lowest mortgage rates available

First-time buyers unaware of mortgage rule changes

Despite aspirations of home ownership, would-be first-time home buyers face significant challenges.

Earlier this year, a new mortgage stress test (called B-20) went into effect. It requires all mortgage holders in Canada to qualify at a higher mortgage rate than the one they are offered by their lender. Specifically, they are now required to qualify at the higher of either the Bank of Canada conventional five-year fixed rate (which, at press time, is 5.34%) or two percentage points higher than their contracted rate.

So, that means a homebuyer who qualifies for today’s best five-year mortgage rate of 3.33% would still hypothetically be required to afford a rate of 5.34%. For many, this means having to purchase a more affordable home than they could have purchased just a year ago: Buyers typically qualify for 20% less home than they would have prior to the rule change.

It turns out, though, that many Canadians are unaware of this impactful mortgage rule change.

Our survey found that 47% of aspiring first-time homebuyers are unaware of these new guidelines. These potential buyers may be wondering “how much mortgage can I afford?” To help determine that, they should play around with a mortgage affordability calculator — which takes into consideration the mortgage stress test when determining affordability.

First-time homebuyers face hurdles

Canadians today are having a tougher time getting into the housing market. And they know it.

Of those currently planning on getting onto the property ladder, 44% identify a lack of funds for a down payment as the primary barrier in their way. An additional 17% are most concerned about housing market uncertainty.

Meanwhile, 12% say their income is currently too low to purchase a home. The Ratehub.ca survey discovered 73% of aspiring first-time homebuyers have a household income of $92,000 or less. For context, a household earning $92,000 can qualify for a home worth $472,132.

In many parts of Canada, $450,000+ could buy quite a bit of home. In markets such as Toronto and Vancouver, however, — where the average home prices are $807,340 and $1,062,100 respectively – those buyers might have to set their sights on surrounding areas.

First-time buyers still keen, despite roadblocks

First-time homebuyers still value home ownership, despite the challenges they face.

As mentioned, 71% of survey respondents plan to purchase a home in the future. This, despite the knowledge of rising home prices and interest rates.

Among survey respondents who currently aren’t owners but plan to be, 66% expect mortgage rates to increase in their province in 2019. Of those who plan to buy next year, 68% expect rates to increase. Finally, 58% believe home prices will rise next year.

Final thoughts

Many first-time home buyers are excited about the prospect of buying, but lack the means to purchase in their local housing market. Many first-time buyers have not saved enough to put together a sufficient down payment on a home. First-time home buyers are also generally unaware of important mortgage qualification rule changes in 2018 that will impact their ability to afford a home in the near future.

A sample of 2,050 Canadian residents from were surveyed by Ratehub.ca from Sep. 24-Oct. 31, 2018 as part of Ratehub.ca’s 2018 Mortgage Survey. For more information about survey findings or to set up a media interview please email Aashti Vijh ([email protected]).

High-resolution graphics can be downloaded here

Photo by rawpixel on Unsplash