How much will it cost to break my mortgage with RBC?

Alyssa Furtado

This piece was originally published on April 2, 2020, and was updated on June 20, 2023.

If you want to refinance your mortgage, transfer it to another lender or sell your house or condo before your current mortgage term is up, you’ll have to pay a penalty fee. Also known as a pre-payment charge, the fee is your lender’s way of penalizing you for breaking your mortgage contract early (resulting in them losing your business – and interest costs – in the process).

What is a pre-payment penalty?

Pre-payment penalties are fees that lenders charge you if you break your mortgage contract early. They are a form of compensation for your lender, and can vary greatly based on several factors.

Looking to refinance your mortgage?

Check out the lowest interest rates available right now!

How to calculate pre-payment penalties

While the big banks all host their own pre-payment calculators now, many of them are convoluted and often surrounded by legal jargon, which makes the calculation that much more confusing. Because of this, we decided to research the ins and outs of each lender’s calculations and build a mortgage penalty calculator of our own.

If your mortgage is with RBC, and you think you’ll need to break your mortgage in the future, here’s a look at how your pre-payment charge will work:

Depending on whether you have a fixed- or variable-rate mortgage, RBC will charge you one of two fees:

- three months’ interest, or the

- interest rate differential (IRD).

If you have a variable-rate mortgage, you simply pay three months’ interest. If you have a fixed rate mortgage, however, you have to pay the greater of three months’ interest or the interest rate differential (IRD). Let’s see how both fees work.

Method 1: Three months’ interest

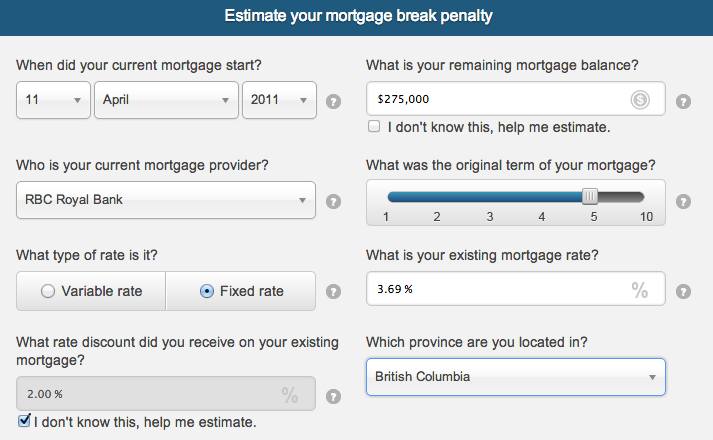

Three months’ interest is exactly what it sounds like: the amount of interest you would have paid during three months of your current mortgage term. While some lenders use their Prime rate (which is only advantageous to mortgage holders whose rates are above Prime, and costs more to those whose aren’t), RBC calculates three months’ interest using your current mortgage rate. Here’s an example we put through our penalty calculator.

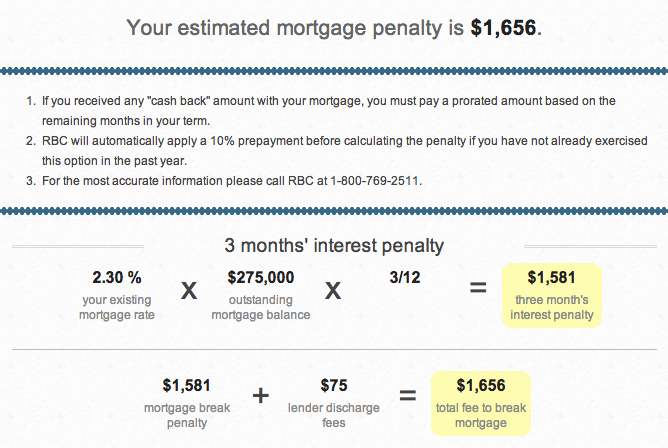

If you still owed $275,000 on your mortgage, three months’ interest would be calculated by multiplying the interest rate (we used 2.30% as an example) by the mortgage balance and again by 0.25 (represented as 3/12 for the three-month period out of the year). As you can see, that equals $1,581. However, on top of the interest charge, you also need to pay a fee to discharge your current mortgage contract from the lender. In British Columbia, RBC’s discharge fee is $75, so we added that into our calculation.

In this example, because you had a variable-rate mortgage, RBC would charge you the three months’ interest penalty fee of $1,581 + $75 to discharge your mortgage for a total of $1,656. Now, if you had a fixed-rate mortgage, you would need to find out if three months’ interest was more or less expensive than the interest rate differential, because you have to pay whichever one is more.

Method 2: Interest rate differential (IRD)

The interest rate differential (IRD) is essentially your lender’s way of determining how much interest they’ll be losing by letting you break your mortgage term early – and making you pay it. To calculate the IRD, your lender looks at your mortgage rate, how much time is left in your mortgage term, and the mortgage rate they could charge someone now for the remainder of your term.

Instead of looking at your current mortgage rate and finding the difference between that and a new rate, RBC finds the posted rate from the day you signed your original term and subtracts today’s posted rate for a product that would cover the remainder of your term from that. Sounds complicated, right? It can be, which is another reason we knew we had to develop this calculator.

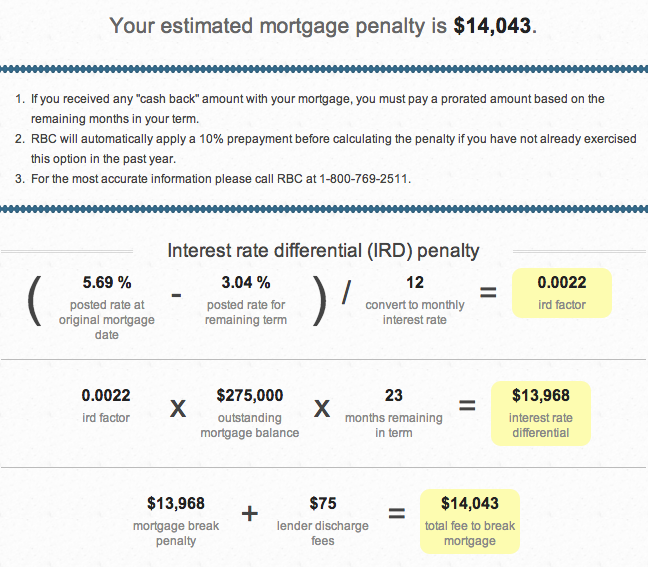

Using the same numbers from our previous example, let’s say your mortgage balance is $275,000 and you have 23 months left in your term. RBC would first figure out what the posted rate was for a 5-year fixed term on the day you originally signed on with them (it was 5.69%). Then, RBC would find out which product would cover the remainder of your term – in this case, you would need a 2-year fixed-rate mortgage, because RBC would round up 23 months to two years.

To calculate the IRD, RBC would find the difference between the old posted rate (5.69%) and today’s posted rate for a 2-year fixed-rate mortgage (which is 3.04%), and multiply it by your current mortgage balance to determine how much interest they’d be losing by letting you break your mortgage term early:

In this example, because you had a fixed-rate mortgage, RBC would charge you the greater of three months’ interest or the interest rate differential (IRD). Since we know three months’ interest was only $1,656, you would have to pay the IRD, which is $13,968 + $75 to discharge your mortgage for a total of $14,043.

Other RBC penalties

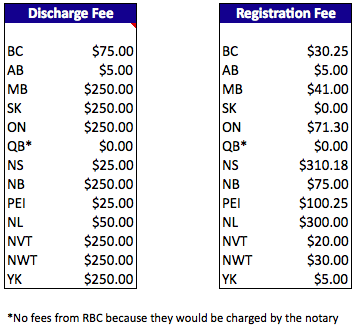

While our mortgage penalty calculator gives you a good estimate of what you’ll have to pay to break your mortgage term early, there can be a number of other fees involved. One of them is the discharge fee, which we’ve included in our calculator; this fee varies from province to province and lender to lender. There may also be a registration fee, depending on which province you live in.

Note that in Quebec, you will pay all other fees through a notary. As well, it’s important for all homebuyers to remember that you may also have to pay a notary or real estate lawyer to complete this entire transaction (i.e. you should budget for legal fees).

Finally, if you took out any cash back when you entered or renewed your mortgage, you will have to return a pro-rated amount back to RBC, which is based on how many months are left in your term.

RBC pre-payment privileges

In order to try and lessen your pre-payment charge, RBC automatically applies a 10% lump sum pre-payment, so long as you have not already done so in the last year; this is a pre-payment option you can take advantage of once each year throughout your term, but is especially helpful when calculating your pre-payment charge. You’re also able to make $500 pre-payments any time you want, without penalty, but that may not save you any money in the short term.

The bottom line

Whatever your reasons for breaking your mortgage, the most important thing is to be informed and prepared. Using the information on this page, as well as our pre-payment penalty calculator, you have everything you need to make the right decision. Good luck!

Also read: