How Much You Need to Earn to Buy a House in the Greater Toronto Area

For home buyers early on in their hunt, at a time of record-high home prices and rock-bottom interest rates, pinpointing exactly what they can afford and where isn’t exactly clear cut.

To give those kickstarting their home search a leg up, we at TheRedPin looked at prices across the Greater Toronto Area and analyzed what your salary needs to be in order buy a house in each of the region’s most prominent cities.

From Toronto at the centre, to Newmarket up north, Oshawa in the east, and Burlington far to the southwest, the range of home prices varies quite a bit and, naturally, so do the salaries required to afford them. It is important to note however, we looked at the combined household income rather than just an individual’s salary.

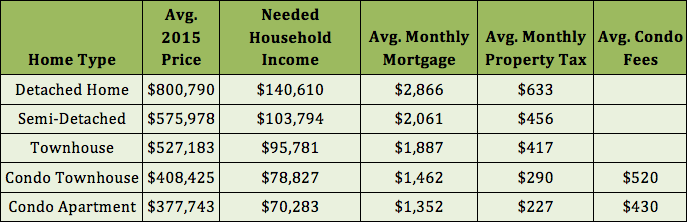

Before we jump head-first into looking at the GTA on a city-by-city basis, the table below is a general overview of the salaries needed across the region to buy property, broken down by housing type:

In regards to the numbers, we utilized mortgage calculators, factoring in an interest rate of 2.49% (given the cuts in the key lending rate), property taxes, and average utility costs running at $250 a month. Condo fees were calculated based on your average 900- and 750-square-foot condo, townhouse, and apartment respectively. Home prices were effective as of July 2015.

The interactive map shown below looks at the needed salary on city-by-city basis with average prices for all home types.

View What you need to earn to buy a home in the Greater Toronto Area [Map] in a full screen map.

The prices highlighted in this analysis cover all home types—detached, semis, towns, and condos combined. With that information in mind, and the fact the figures are more reflective of single family homes, we considered a down payment of 20% was made, which is more in-line with repeat buyers who have built up equity.

Below is a complete list of what you need to afford an average home in each of Greater Toronto Area’s largest 16 housing markets:

Burlington

Average Home Price: $588,667

Needed Household Income: $103,660

Avg. Monthly Mortgage: $2,107

Avg. Monthly Property Tax: $407

Property Tax Rate: 0.83%

Milton

Average Home Price: $542,415

Needed Household Income: $94,376

Avg. Monthly Mortgage: $1,941

Avg. Monthly Property Tax: $325

Property Tax Rate: 0.72%

Oakville

Average Home Price: $828,181

Needed Household Income: $142,562

Avg. Monthly Mortgage: $2,964

Avg. Monthly Property Tax: $587

Property Tax Rate: 0.85%

Brampton

Average Home Price: $487,884

Needed Household Income: $91,631

Avg. Monthly Mortgage: $1,746

Avg. Monthly Property Tax: $451

Property Tax Rate: 1.11%

Mississauga

Average Home Price: $552,114

Needed Household Income: $98,866

Avg. Monthly Mortgage: $1,976

Avg. Monthly Property Tax: $409

Property Tax Rate: 0.89%

Toronto

Average Home Price: $618,202

Needed Household Income: $105,975

Avg. Monthly Mortgage: $2,213

Avg. Monthly Property Tax: $363

Property Tax Rate: 0.71%

Aurora

Average Home Price: $738,630

Needed Household Income: $130,466

Avg. Monthly Mortgage: $2,644

Avg. Monthly Property Tax: $585

Property Tax Rate: 0.95%

Markham

Average Home Price: $800,318

Needed Household Income: $136,835

Avg. Monthly Mortgage: $2,864

Avg. Monthly Property Tax: $534

Property Tax Rate: 0.80%

Newmarket

Average Home Price: $606,683

Needed Household Income: $109,791

Avg. Monthly Mortgage: $2,171

Avg. Monthly Property Tax: $501

Property Tax Rate: 0.99%

Richmond Hill

Average Home Price: $877,114

Needed Household Income: $149,881

Avg. Monthly Mortgage: $3,139

Avg. Monthly Property Tax: $607

Property Tax Rate: 0.83%

Vaughan

Average Home Price: $792,775

Needed Household Income: $135,635

Avg. Monthly Mortgage: $2,837

Avg. Monthly Property Tax: $548

Property Tax Rate: 0.83%

Whitchurch–Stouffville

Average Home Price: $773,665

Needed Household Income: $134,269

Avg. Monthly Mortgage: $2,769

Avg. Monthly Property Tax: $561

Property Tax Rate: 0.87%

Ajax

Average Home Price: $489,137

Needed Household Income: $94,912

Avg. Monthly Mortgage: $1,750

Avg. Monthly Property Tax: $522

Property Tax Rate: 1.28%

Pickering

Average Home Price: $526,872

Needed Household Income: $98,702

Avg. Monthly Mortgage: $1,886

Avg. Monthly Property Tax: $496

Property Tax Rate: 1.13%

Whitby

Average Home Price: $485,744

Needed Household Income: $94,381

Avg. Monthly Mortgage: $1,738

Avg. Monthly Property Tax: $526

Property Tax Rate: 1.30%

Oshawa

Average Home Price: $347,737

Needed Household Income: $73,117

Avg. Monthly Mortgage: $1,244

Avg. Monthly Property Tax: $455

Property Tax Rate: 1.57

- Stats based on 2015 January to July figures from the Toronto Real Estate Board

- Interest rate: 2.49%

- Amortization: 25 years

- Monthly utility costs average: $250

- Down payment: 20%

- Condo fees estimated for 900 and 750 square foot condo town and apartment respectively

- Property tax calculated on a per-city basis

TheRedPin is a full-service real estate brokerage that carries the largest database of residential listings in the Greater Toronto Area. Sign up to our newsletter simply by clicking here.

Flickr: Paul Bica