Save Money on Your Mortgage Using the Three-Legged Stool Method

Ratehub Staff

This piece was originally published on April 9, 2014, and was updated on October 19, 2022.

Flickr: D68 design+art

With today’s record-breaking housing prices, homebuyers are taking out larger mortgages than ever before. With larger mortgages comes higher mortgage payment amounts and added interest costs, so the incentive to save money wherever possible is high. If you’re wondering what the most effective way to save money on your mortgage is, there’s more than one answer – and I want you to use all of them. Keep reading to find out what I mean.

Factors That Affect the Cost of Your Mortgage

There are three major factors that will affect how expensive your mortgage is over time:

- The principal or mortgage amount;

- The mortgage rate; and

- The amortization period.

These three factors are like the legs of a stool – holding up the cost of your mortgage. Shortening any of the legs will save you money on your mortgage, but which leg will save you the most? Let’s take a look at examples of how to save on each, with calculations run through Ratehub.ca’s mortgage payment calculator.

Principal or Mortgage Amount

This one is the most obvious: buying a cheaper home and taking out a smaller mortgage means your overall mortgage costs will be less expensive – including both the principal amount you borrow and your interest costs.

For example, if you bought a $400,000 home, put $80,000 down (20%) and took out a $320,000 mortgage at 2.84% amortized over 25 years, you would pay a total of $126,471 of interest over the life of your mortgage.

If, instead, you bought a $350,000 home, put your $80,000 down (23%) and took out a $270,000 mortgage at 2.84% amortized over 25 years, you would pay just $106,710 of interest. That’s close to $70,000 that you could shave off your mortgage ($50,000 of principal + approx. $20,000 of interest)!

Of course, with housing prices higher than ever before, taking out a smaller mortgage is often easier said than done, so keep reading to find alternative ways to save on your mortgage.

Mortgage Rate

Any mortgage broker will tell you that getting the best mortgage rate is a great way to save on the cost of your mortgage. But just how much can you save? Well, let’s take a look.

Let’s say you bought a home for $350,000, put down $70,000 (20%) and took out a $280,000 mortgage amortized over 25 years. Your bank offers you a 5-year fixed rate of 3.50% but, after speaking with a mortgage broker, you find out you can get a better rate.

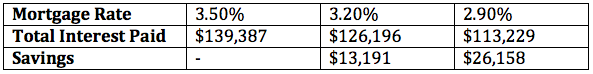

The table below shows the total interest paid over 25 years, using three different interest rate scenarios:

As you can see, negotiating for a better rate – one that is even just 0.30% less than what the bank offered you, can help you shave tens of thousands of dollars off your mortgage. But don’t run off to negotiate a better rate just yet – there is one final leg on this stool that will help you save even more money.

Amortization Period

Your amortization period is the total length of time it takes you to pay off your mortgage. In Canada, the maximum amortization period you can get is 25 years, so that’s what most people sign on for. But the shorter your amortization period is, the less interest you’ll pay. Exactly how much less interest? Let’s go back to our example from above. If you're interested in focusing on how your amortization period affects your payments over time and are curious how your payments might be affected with a longer or shorter amortization period, you can generate multiple amortization schedules under different amortization period scenarios using our amortization calculator.

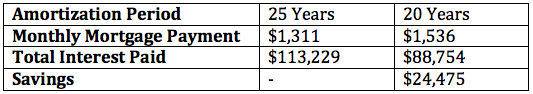

So, you bought that $350,000 home, put down $70,000 and took out a $280,000 mortgage. And you even negotiated for the best 5-year fixed rate of 2.90%. Here’s a look at how shortening your amortization period from 25 years to 20 years would affect your mortgage costs:

By signing on for a 20-year amortization period on the day you take out your mortgage, you could slash more than $24,000 of interest off your mortgage costs. Of course, shortening your amortization period means increasing your monthly mortgage payment amount, so you can become mortgage-free sooner. But if it’s in the budget, I’d urge you to do this.

Your Mortgage: A Three-Legged Stool

In order to save as much as possible on your mortgage, you should think of it as a three-legged stool. Instead of focusing on just one of the “legs” outlined above, focus on all of them. If you shorten just one of the legs on a stool, you’ll be left in an uncomfortable position. Instead, if you shorten all three legs, you’ll be in a balanced position throughout the duration of your mortgage.

In short, if you want to save the maximum amount of money possible, take the following steps:

- Minimize your mortgage amount by not overextending yourself when it comes time to buying a home.

- Work with a mortgage broker to get today’s best mortgage rate.

- Reduce your amortization period, either right from the start or by taking advantage of your prepayment options throughout the life of your mortgage.

This three-pronged approach will ensure you save thousands on your overall mortgage costs.

Also read:

- The Trigger Rate: Everything You Need to Know

- The New Tax-Free First Home Savings Account

- Mortgages and Inflation: How Do They Affect Each Other?

- The Bank of Mom and Dad and Your Down Payment

- How Does the Rising Stress Test Impact Mortgage Affordability?

- Should You Switch From a Variable-Rate to a Fixed-Rate Mortgage?