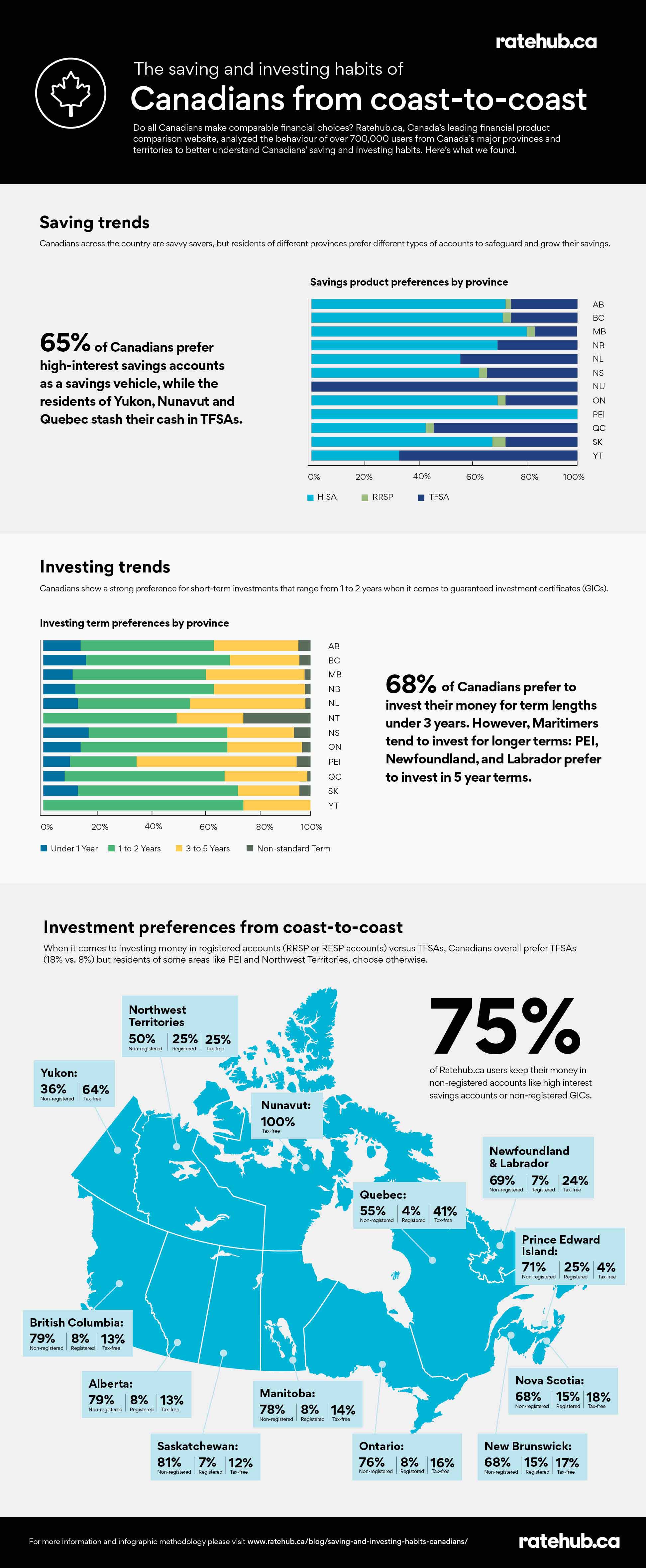

The Saving and Investing Habits of Canadians, from Coast-to-Coast

Banking products rarely come to mind when we think about notable Canadian inventions. But on that long, valorous list—somewhere between poutine and maple syrup—sit some of the most beneficial saving and investing accounts ever invented. These accounts are Guaranteed Investment Certificates (GICs), High-Interest Savings Accounts (HISAs), the Registered Retirement Savings Plan (RRSP), and the Tax-Free Savings Account (TFSA).

Saving and investing accounts may not be as exciting as a box of fries covered in gravy and curds, but they do serve up some serious benefits that are worth celebrating.

In fact, findings from an Edward Jones survey conducted earlier this year found that three out of every four Canadians* prioritized saving or investing.

The survey, while well-executed, didn’t grant any insight into how Canadians were choosing to save or invest their money.

That’s why Ratehub.ca decided to dig deeper and figure out what types of savings accounts Canadians placed their money inside.

To answer this question, the Ratehub.ca team looked at its own data, involving 700,000 users across both Canadian coasts, to figure out what accounts Canadians were using to save and invest their money.

What Savings and Investing Accounts Do Canadians Use?

As a rate-comparison website, Ratehub.ca helps thousands of people from all financial backgrounds find the best interest rates in Canada each and every day. The information we’ve gathered through our diverse customer base allows us to figure out what accounts our customers preferred when it came to banking and investing.

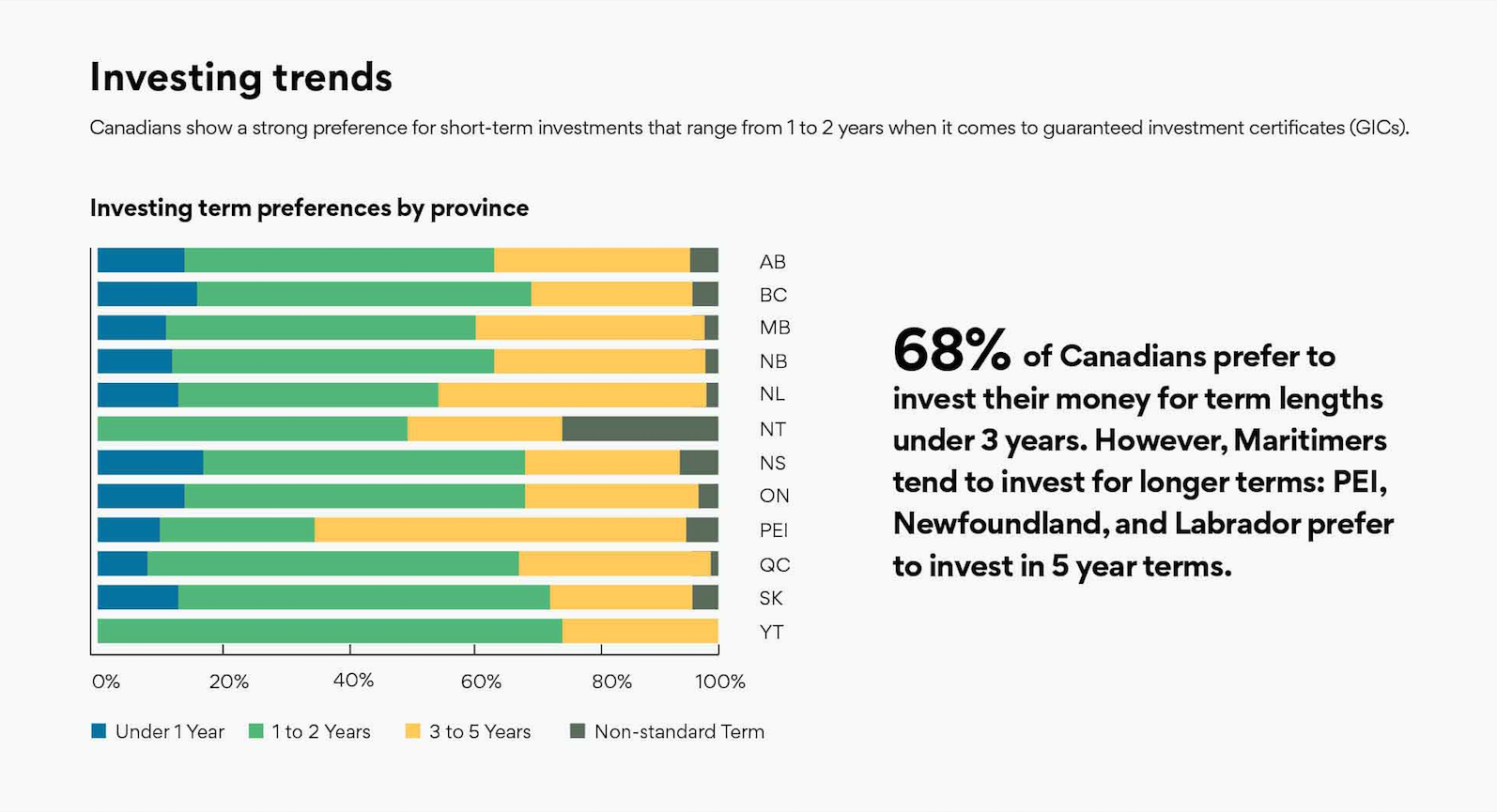

How Long Do Canadians Invest Their Funds for?

The chart below shows our finding in Canada’s attitude towards GICS, and how popular the investing tools are in each province or territory.

Generally speaking, 1 to 2-year GIC terms proved to be the most popular among Canadians. Saskatchawanians—who showed the most love for GICs out of any province or territory in Canada—invested in 1 to 2-year GICs most. Though residents of Nunavut, who are particularly fond of the TFSA, did not show enough activity for measurement, were not included in the chart below.

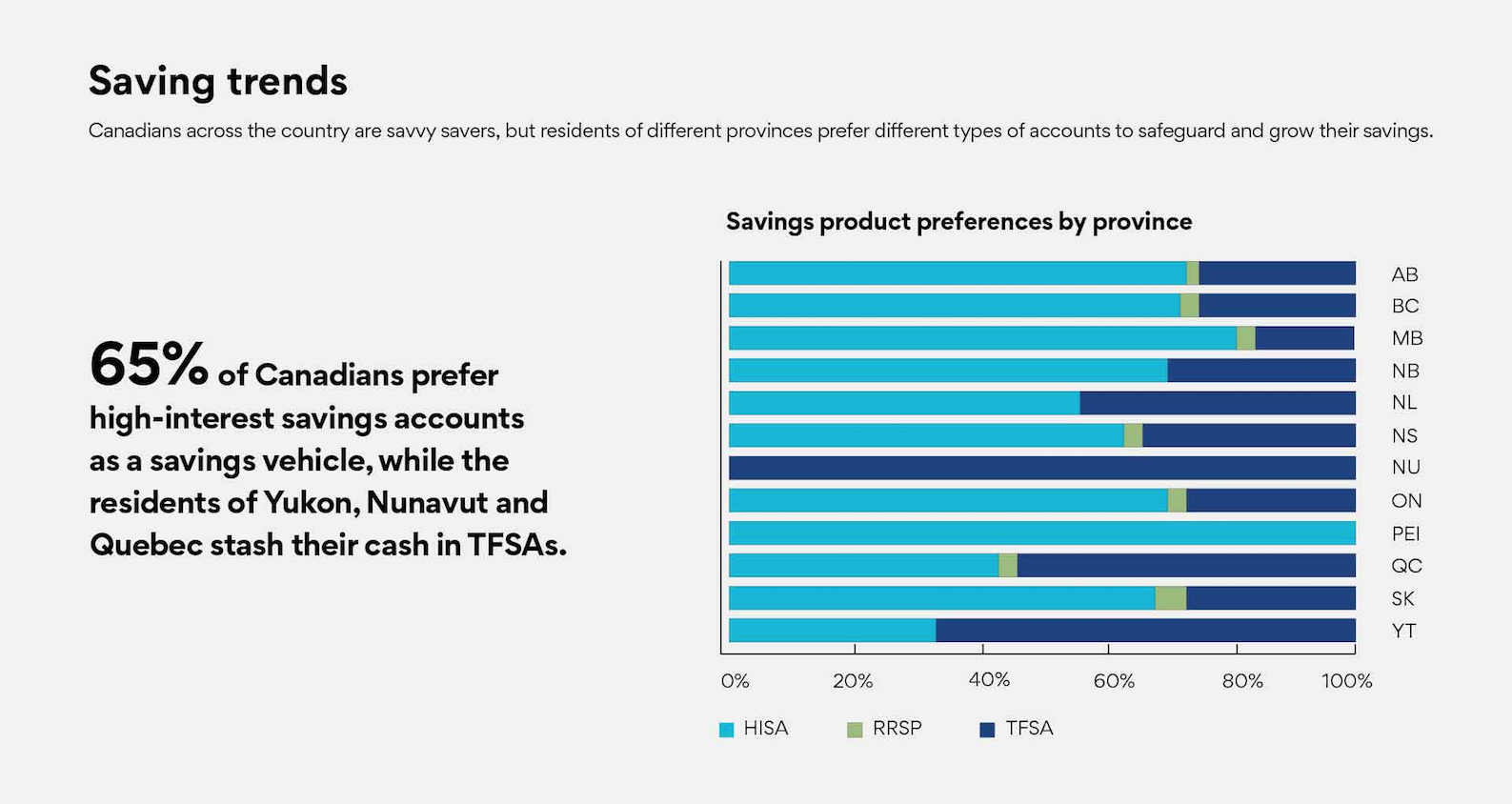

Which Savings Accounts are the Most Popular with Canadians?

When it comes to savings accounts, Canadians seemed to be a little more divided. Using High-Interest Savings Accounts (HISAs), Registered Retirement Savings Plans (RRSPs), and Tax-Free Savings Accounts (TFSAs) show a much different divide between saving and investment options.

For example, as the chart below will show, all of our users in Prince Edward Island gravitated towards opening high-interest savings accounts. On the other hand, 100% of users in Nunavut chose the tax-free savings account as their account of choice. was their saving method of choice.

Unfortunately, not enough data was collected for residents in the Northwest Territories and the territory is not included in the chart below.

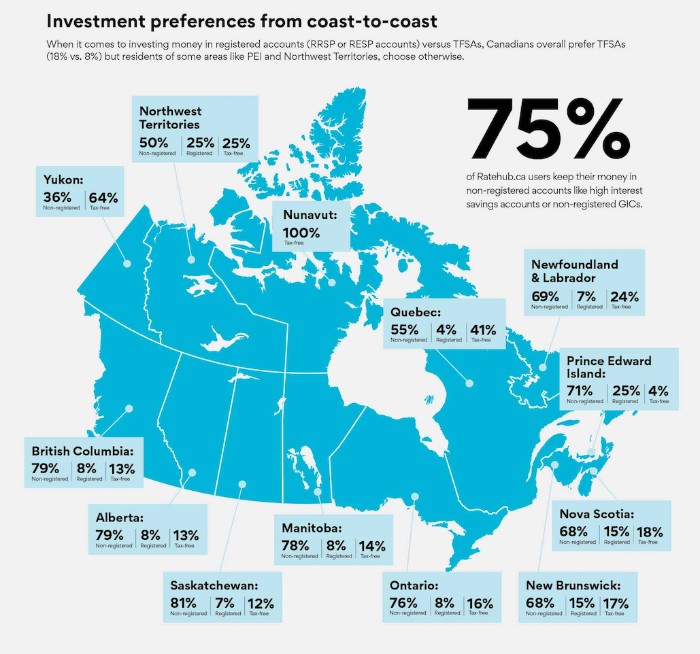

Investing Preferences By Province and Territory

Ratehub.ca data brought forth some interesting information. Users who opened non-registered, registered, and tax-free banking products in Canada seemed to prefer non-registered products overall. In second, tax-free accounts proved to be the most popular.

Registered accounts were the least popular among all provinces and territories.

Non-Registered

Non-registered accounts are accounts with no contribution limit. Interest accrued within them is taxed and usually provide flexibility terms around withdrawals. An example of a non-registered account is the high-interest savings account.

In general, Canadians leaned towards non-registered accounts. Citizens of Saskatchewan, Alberta, and British Columbia opened the most non-registered accounts through Ratehub.ca.

Tax-Free Accounts

Tax-free accounts, such as the Tax-Free Savings Account, were the second most popular type of account among Canadians. Nearly one-fifth of Canadians chose a the tax-free savings account over other accounts.

Despite earning tax-free interest, TFSAs proved to be the second most popular. Every visitor from Nunavut showed interest in the TFSA, with 64% of Yukon residents following in second.

EQ Bank Personal Account

- Transaction fees

- No charge

- E-transfer

- No charge

- Earn 4% interest (1.25% everyday rate + 2.75% bonus interest when you direct deposit your pay)

- Features of chequing without any of the fees

- Pay bills, send & receive e-transfers, set up pre-authorized debits

- Zero everyday banking fees (no monthly fees, transaction fees, etc)

- Free access to any ATM in Canada with the EQ Bank Card (we reimburse any domestic ATM fee incurred)

- Free e-transfers and no monthly fees

Interest paid: monthlyMinimum balance: $0 Insurance: CDIC eligible

Registered Accounts

Registered Accounts, on the other hand, provide tax-benefits and untaxed interest. They do, however, come with contribution limits.

Accounts like RRSPs are registered accounts and proved to be the least popular among our users, with an average of 8% leaving our site with a registered account.

Prince Edward Island and Nunavut ranged highest for these types of accounts

Also, read: