How a lower finance rate on a new car may cost more money

Looking to purchase a new vehicle and get the best possible deal? Generally, when we think of financing a vehicle, we assume that the lowest interest rates always ensure the lowest monthly payment. However, there are many different scenarios where this logic is flawed, such as when we factor in vehicle incentives.

What are vehicle incentives?

An incentive is a discount on a vehicle the manufacturer offers to lower the total cost of the vehicle. You can apply these additional discounts to the three main purchase types: cash, finance, and lease. The latest incentives are always available on Unhaggle.com.

Cash Incentives

Cash incentives are one of the most common types of incentives available to a consumer. If you buy a vehicle in cash, the manufacturer can issue a discount. You can qualify for a cash incentive if you finance your new vehicle purchase through a bank.

Finance Incentives

Given that many people don’t have extra cash reserves available for a brand-new vehicle, many people opt for financing. Term lengths can vary based on personal preference, and you can choose to finance your new vehicle over a period of two to five years. You typically see these finance incentives ads with a 0% finance rate. Sometimes it can help you with a reduction in the selling price.

Lease Incentives

Lease incentives function in a similar way to finance incentives and provide lower rates and/or an additional discount on the price of the vehicle. These effectively lower the amount you pay in interest and/or lowers the overall cost of the vehicle, meaning you will pay less over the course of your lease term.

While leasing may not always be the best financial choice, it can provide more flexibility. At the end of your lease term, you must return your vehicle to the dealership or buy out the remaining balance on the vehicle, while at the end of your finance term, the vehicle is yours.

How to maximize your savings when buying a new vehicle

If the idea of a higher interest rate saving you money sounds absurd – it should. Higher interest rates generally result in higher payments. But remember, you can combine cash incentives with auto loans.

So, if the cash incentive is large enough, the amount you save upfront could be more than you would save on interest over the course of your loan.

Below, we have a report from Unhaggle.comwhich illustrates and breaks down the costs and savings in a situation where this is true. Let’s use the 2020 Nissan Rogue SL Platinum, for example. First, let’s navigate to the site and select our vehicle.

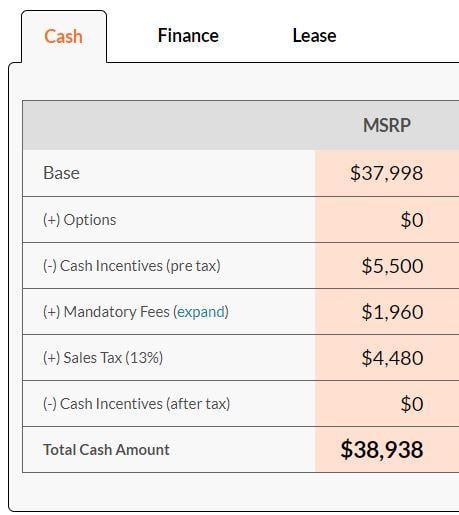

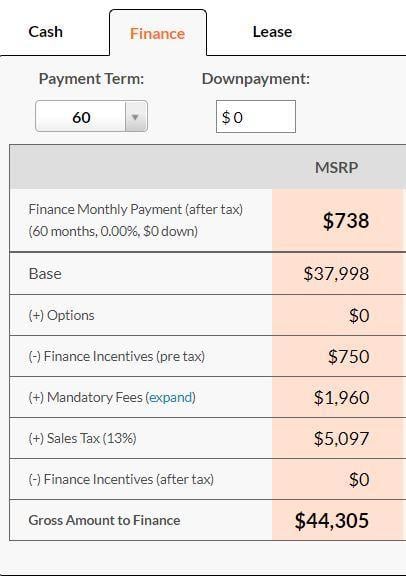

After entering your information, we arrive at the Dealer Cost Report, which has information on the vehicle of your choice, including pricing and incentives. As you scroll down, you get pricing information. We can take these values to compare a bank rate versus the advertised subvented one.

Let’s compare the two scenarios side by side. Take the base MSRP (as well as any options you would like to add in), subtract the incentive, and then add the mandatory fees to get the vehicle price before tax. Alternatively, we can just take the “Total Cash Amount” and the “Gross Amount to Finance” and divide each of them by the tax rate (13%) to get the vehicle price before tax for the next step.

Should you finance a car through a dealer or a bank?

Below, it shows the advertised finance rate option totalling $39,208.

Further along, it shows the cash purchase or auto loan including the cash incentive is $34,458.

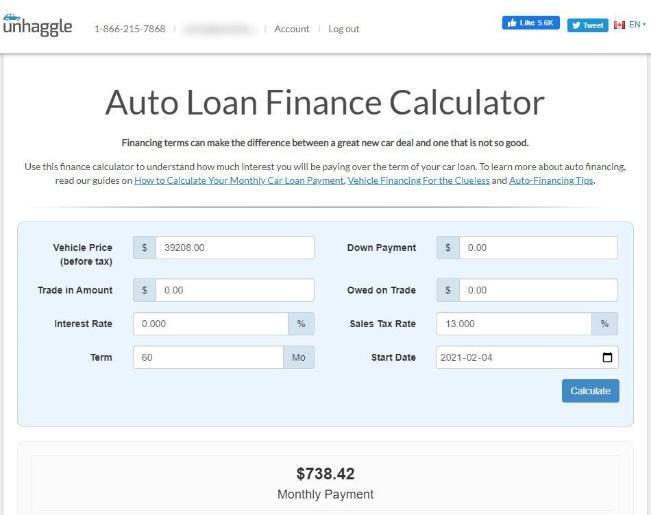

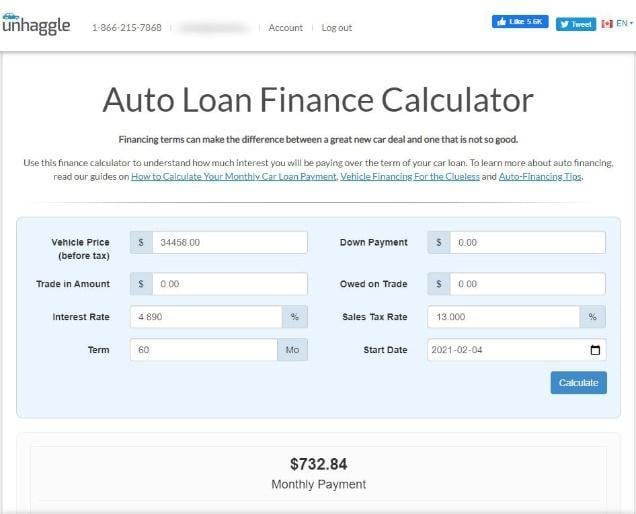

For the purpose of this example, the auto loan rate we use with the cash incentive is 4.89% and 0% for the subvented rate. Please note that the actual interest rates both from the bank and the one the manufacturer advertises are subject to credit approval. Now we’ll put the information into the Auto Loan Finance Calculator.

After entering our information, we can see the monthly payments made on the finance plan with a 4.89% interest rate with a $5,500 cash incentive are less than the payments that took the advertised finance rate with the $750 cash incentive.

In this case, it’s better to opt for the higher bank rate with the cash incentive because it leads to a lower monthly payment. This may not always be the case, but just make sure to research before you commit to your payment plan!

The bottom line

In essence, don’t automatically assume that the lower interest rate will always save you money. Although interest rates tend to cause a nasty rise in cost, especially over longer terms due to their compounding nature, they might not be the worst thing in the world.

Take advantage of free payment calculators such as the one offered by Unhaggle.com to take care of the calculations as you compare possible payment plans. These tools are designed to help you calculate prices and assist you in finding the best possible deal for your new vehicle, so you do not fall into pitfalls like this one.

ALSO READ