Top 3 Credit Cards for Students in 2015

We all remember the days of living like a student; hunting for the best deals on groceries, frequenting bars with the cheapest happy hours and so on. When you’re earning little-to-no income, it can actually become even more important to earn some rewards on the spending you are doing. The good news for you is that there are some no fee credit cards that still offer great rewards for students. Here are a few of our favourites.

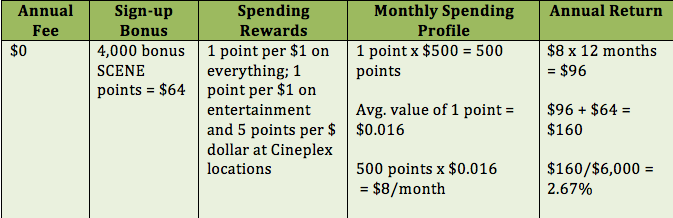

*Note: To compare the best credit cards for students, we set a monthly spend of $500 on “everything”.

1. Scotia SCENE Visa

If you’re in the market for a new student credit card, the Scotia SCENE Visa is the best one on the market. Not only does the card come with 4,000 SCENE points when you sign-up, which are valued at $64, it has no annual fee and lets you earn SCENE points no matter where you shop. The sign-up bonus points are worth the equivalent of 4 free movie tickets, which means you can start seeing the return right away, and the SCENE program recently added the option to redeem points for discounts at Sport Chek – a great option for student athletes. All around, it’s the best no fee credit card option for students.

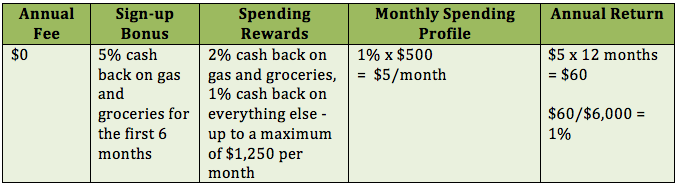

2. MBNA Smart Cash Platinum Plus

If you’d rather earn cash back than SCENE points, the next best option for students is the MBNA Smart Cash Platinum Plus credit card. This card is perfect for students because it has no annual fee and gives you cash back for every $1 you spend. You’ll earn 5% cash back on gas and groceries for the first 6 months, then it switches to 2%, which is still a great return. And if you’re shopping for anything else, like books, you’ll still earn 1% cash back – up to a maximum of $1,250 per month. If you’re a student who loves to travel, one other benefit of this card is the incredible travel insurance policies

3. MBNA Platinum Plus MasterCard

Finally, if you’re just looking for your very first credit card, the MBNA Platinum Plus MasterCard is a good option. This card doesn’t offer any rewards, but it also has no annual fee, so it can be a great tool to help you learn how to use credit and begin to build up your credit history.

In general, no fee credit cards are always a great option for students who want to build credit before they finish school and enter the “real world”. Good credit can help you rent an apartment, apply for other rewards credit cards in the future, and eventually help you get the best mortgage rates when you decide to buy a home. And since you’re likely not earning much money in school, there’s no point getting a card that charges a high annual fee, right?

As a student, you know that every dollar counts – and if you’re a responsible borrower, a rewards credit card can help you get a better return on your regular everyday purchases. Just make sure you control your spending, so you don’t end up spending more money than you can afford and get stuck with a bill you can’t pay off in full; there’s no point in using a rewards credit card if you’re being charged interest on your purchases.