What is a Second Mortgage?

Flickr: reallyboring

“We’ll have to get a second mortgage on the house!” It’s a phrase you’ve probably heard on TV sitcoms for years – one that conjures up images of the characters so deep in debt, they have to take drastic measures to get out of it. But what exactly is a second mortgage? Why would a homeowner need one? Which lenders offer these loans? And what does it take to qualify? Today, we want to clear up any questions or confusion you may have about the subject.

What is a second mortgage?

The simplest definition is that a second mortgage is a mortgage taken out on a home that is already mortgaged. For the lender, a second mortgage is riskier than the first mortgage, because the loan is in second position on your property’s title. For example, if you (the homeowner) defaulted on your mortgage payments and your home was taken into possession by the bank and sold off to repay what you owed on it, the lender in first position would be paid out first. Depending on how much the home is worth versus the amount you owe, the lender in second position runs the risk of not being repaid in full. To compensate for this risk, mortgage rates for second mortgages are always higher than what you could get on your first mortgage.

Why would a homeowner get a second mortgage?

Similar to your first mortgage, a second mortgage is often used as a loan for large expenditures that may otherwise be difficult to finance. For example, you could use it to purchase a new vehicle or even a boat. More commonly, however, a second mortgage is used to consolidate any high interest debt you may have. While some homeowners may get a home equity line of credit (HELOC) for this, someone with a lower credit score may not be approved for one – that’s where a second mortgage can come in.

Even though you’ll pay a higher interest rate on your second mortgage than on your first mortgage, the rate would probably still be lower than any line of credit, car loan or credit card. An added bonus of taking out a second mortgage to consolidate debt is the opportunity it gives you to improve your credit score. So long as you don’t miss any scheduled payments, it could be a great tool to help you meet your financial commitments and boost your score along the way.

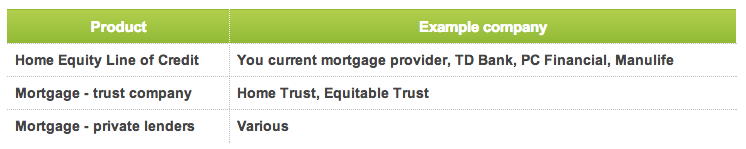

Which lenders offer second mortgage loans?

Technically, any lender could offer a second mortgage loan, however, a lender’s risk tolerance will determine what types of loans they will offer and to whom. Most of the big banks in Canada are more likely to offer you a HELOC, to avoid the added risk that second mortgages carry (i.e. potentially never being repaid in full). If you have weaker credit and/or little equity in your home, you may have to talk to trust companies and private lenders about loaning you a second mortgage instead. Just keep in mind that the interest rate will be much higher with one of these two types of lenders, compared to what you’d pay if you got a HELOC from a bank.

What do I need in order to qualify for a second mortgage?

In order to qualify for a second mortgage, lenders will look at four things:

- Property. Lenders need to secure their investment, in case you are unable to keep up with your mortgage payments and end up defaulting on your loan.

- Equity. The more equity you have in your home, the higher your chances of qualifying for a second mortgage will be.

- Income. Lenders need to verify you have a dependable source of income, to ensure you can make your payments.

- Credit score. Finally, the higher your credit score, the lower your interest rate could be.

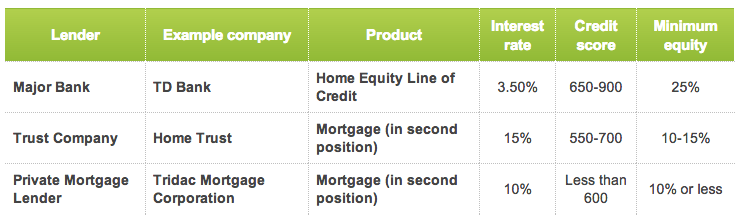

Here you can see how different types of lenders take this information into account:

In the end, a second mortgage is just another option to consider if you want access to money fast and are willing to leverage your home to get it. Despite the fact that your lender may offer you a HELOC instead, you are still leveraging your greatest asset in order to get access to cash. If you want to consolidate high interest debt into one loan with a smaller interest rate, a second mortgage may be a great option for you. As always, if you want to find out which option could be best for your current financial situation, find a mortgage broker in your area that you can speak to.