When Buying a Home, Don’t Forget to Pay the Taxes

When you first start thinking about buying a home, we know the top two things on most people’s minds are: how much can I spend and how much will the monthly mortgage payment be? There’s no doubt these are two of the most important questions you can ask yourself, before buying a home, because you should know your limitations and not try to stretch your finances too thin. However, like with most purchases we make, there’s one thing we often overlook before buying a home: how much tax we’ll have to pay. Believe it or not, there are a few you’ll have to consider. Take a look:

PST on CMHC Insurance

If you don’t save enough to put down 20% or more of your home’s purchase price, you will need to purchase mortgage default insurance (otherwise known as CMHC insurance, because they are the largest provider of it). CMHC insurance protects your lender in the event that you ever had to default on your mortgage. If you’ve used our mortgage payment calculator, you know the premium is added to your mortgage and paid off over the life of your loan. The premiums aren’t cheap, but at least you don’t have to save and pay for it upfront, right?

What you may not realize, however, is that some homebuyers have to pay the provincial sales tax (PST) on their CMHC insurance premium. That’s right – if you live in Manitoba (7%), Ontario (8%) or Quebec (9.975%), you have to pay PST on your CMHC insurance. For example, if you bought a condo in Toronto and your CMHC insurance premium was $6,200, the PST would be:

$6,200 x 8% = $496

On closing day, before you could sign all the papers, take the keys and go to your new home, you would have to pay $496 of PST on your CMHC insurance premium.

GST/HST on a Brand New Home

PST on CMHC insurance may not amount to much – at least, in comparison to this next tax. If you buy or build a brand new home in any province, you will need to pay the federal goods and services tax (GST) on the purchase price – or the harmonized sales tax (HST), if you live in a province that has it. As you can imagine, neither option is cheap.

For example, if you bought a brand new home in Calgary for $500,000, the GST would be:

$500,000 x 5% = $25,000

If you bought a brand new condo in Toronto for the same price, the HST would be:

$500,000 x 13% = $65,000

You’ll end up paying GST/HST one of two ways: the developer will either build it into the sales price, which means you’ll pay for it through your mortgage, or you’ll have to pay for it with cash on closing day. Fortunately, no matter where you live in Canada, if your new home is priced below $450,000 before GST/HST, you may be eligible for a partial rebate of the 5% GST portion, through the GST/HST New Housing Rebate.

Prepaid Property Taxes

As a homeowner, one of the carrying costs you’ll need to pay for is your property tax. Property taxes are charged by the municipality you live in, and are used to pay for services such as garbage and recycling collection, sewer protection, road and draining maintenance, snow removal, street lighting, policing, fire protection and more. The amount may change slightly each year, but did you know you might actually have to pay a portion of it upfront, when you first purchase your home?

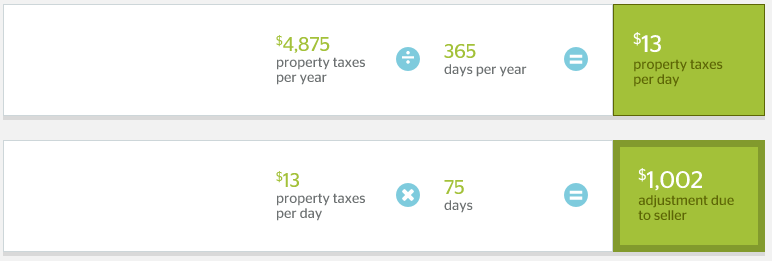

Well, that’s what happens, if the seller has prepaid their property taxes for the year. For example, if your closing date is 75 days before the end of the year, you’ll need to pay the seller the amount they’ve paid for those 75 days. Using some example numbers, here’s how the calculation works:

Of the $4,875 the seller prepaid for their property taxes, you would need to pay back $1,002 – and that amount must be paid for with cash on closing day.

Ok, so these aren’t all like the taxes we pay on regular purchases… but you get the idea! Beyond just buying a home and needing to take out a mortgage to do so, there are a number of other closing costs you’ll need to pay for, and the taxes outlined in this post may be some of them.

Flickr: American Advisors Group