Will Meridian's Low 1.49% Mortgage Rate Actually Save You Money?

If their logo doesn’t make you smile already, this announcement might: Meridian Credit Union is now offering a 1.49% 18-month fixed rate mortgage product to its members. It is, quite literally, the lowest mortgage rate in Canadian history – and it’s only available in Ontario.

“With this mortgage offering, we will be helping Ontarians to pay off their mortgages sooner while saving money in interest costs,” Bill Whyte, Chief Member Services Officer for Meridian, announced in a press release yesterday. And the numbers prove it’s true – that is, only for 18 months and only if mortgage rates don’t climb in the near future.

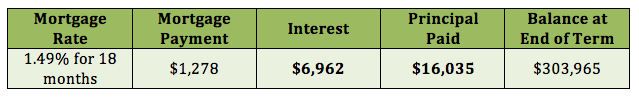

Look at these numbers.

Say you bought a home today for $400,000 with 20% down ($80,000), which meant you needed to take out a $320,000 mortgage. If you got this new rate from Meridian, you’d only be charged $6,962 interest in those first 18 months. Sounds pretty good, right?

But what happens when those 18 months pass and you need to renew the outstanding balance of $303,965?

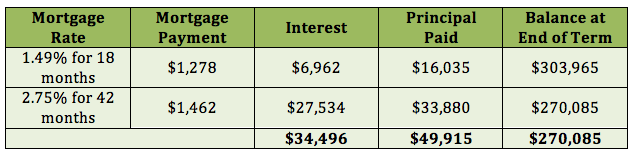

If mortgage rates remained the same as what they are today, you might be able to qualify for Meridian’s 2.75% 5-year fixed rate. For the sake of simplicity, let’s calculate what you’d pay in the first 42 months of that term, for 60 months (5 years) total.

In this example, if you had a 1.49% interest rate for 18 months and a 2.75% rate for the next 42 months, you’d be charged $34,496 interest in the first 5 years of your mortgage.

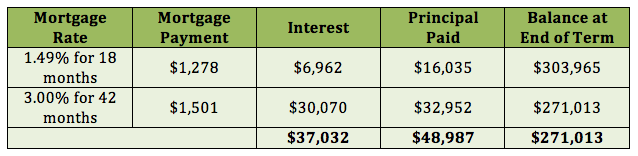

But what happens if interest rates go up? And not by much – but what would happen if, in 18 months, Meridian’s new 5-year fixed rate jumped to 3.00%?

In that example, you’d be charged $37,032 interest in the first 5 years of your mortgage.

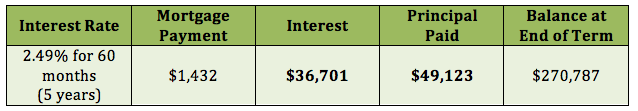

Now, how does this compare to if you’d just gotten a 2.49% 5-year fixed rate mortgage right from the start (which is currently the best mortgage rate on our site)?

In that case, you’d be charged just $36,701 interest throughout the term.

Conclusions:

- If mortgage rates remained as low as they are today, and you were able to lock in Meridian’s best 5-year fixed rate (currently 2.75%) after your 18-month term was up, you’d save$2,205 in interest over the first 5 years of your mortgage, compared to if you’d gone with 2.49% for 5 years.

- However, if interest rates climbed – which is extremely likely, as they are ultra-low right now – so the best 5-year rate you could get after your 18-month term was up was 3.00%, you’d be better off getting a 2.49% mortgage for 5 years. This decision would only save you $331, but it’s better than nothing – and it’s far better than taking the risk that mortgage rates could climb even higher in the future.

Of course, with all of this being said, we can see why the media is making a big deal about Meridian’s offer. On top of it being the lowest mortgage rate in history, it’s a decent mortgage product – one that doesn’t come with any troublesome restrictions.

Borrowers have to qualify for the Bank of Canada benchmark rate, which is currently 4.64%, so it stops people from taking on more debt than they can afford to repay. It has a non-collateral charge, which means you can easily switch it to another lender, when your mortgage comes up for renewal after 18 months. It even has 20%/20% prepayment privileges. And all you have to do, to get it, is become a member ($25 deposit) of Meridian Credit Union and visit one of its 67 locations so you can apply in-person (you cannot apply online).

But if you’re thinking of switching providers and bringing your mortgage over to Meridian to get this offer, it may not be worth the hassle – especially in a rising interest rate environment. If mortgage rates go up even slightly in the future, it won’t save you money in the long-term.

And, while there is no set expiry date on the offer, Meridian has told us that it will only be available for a limited time.