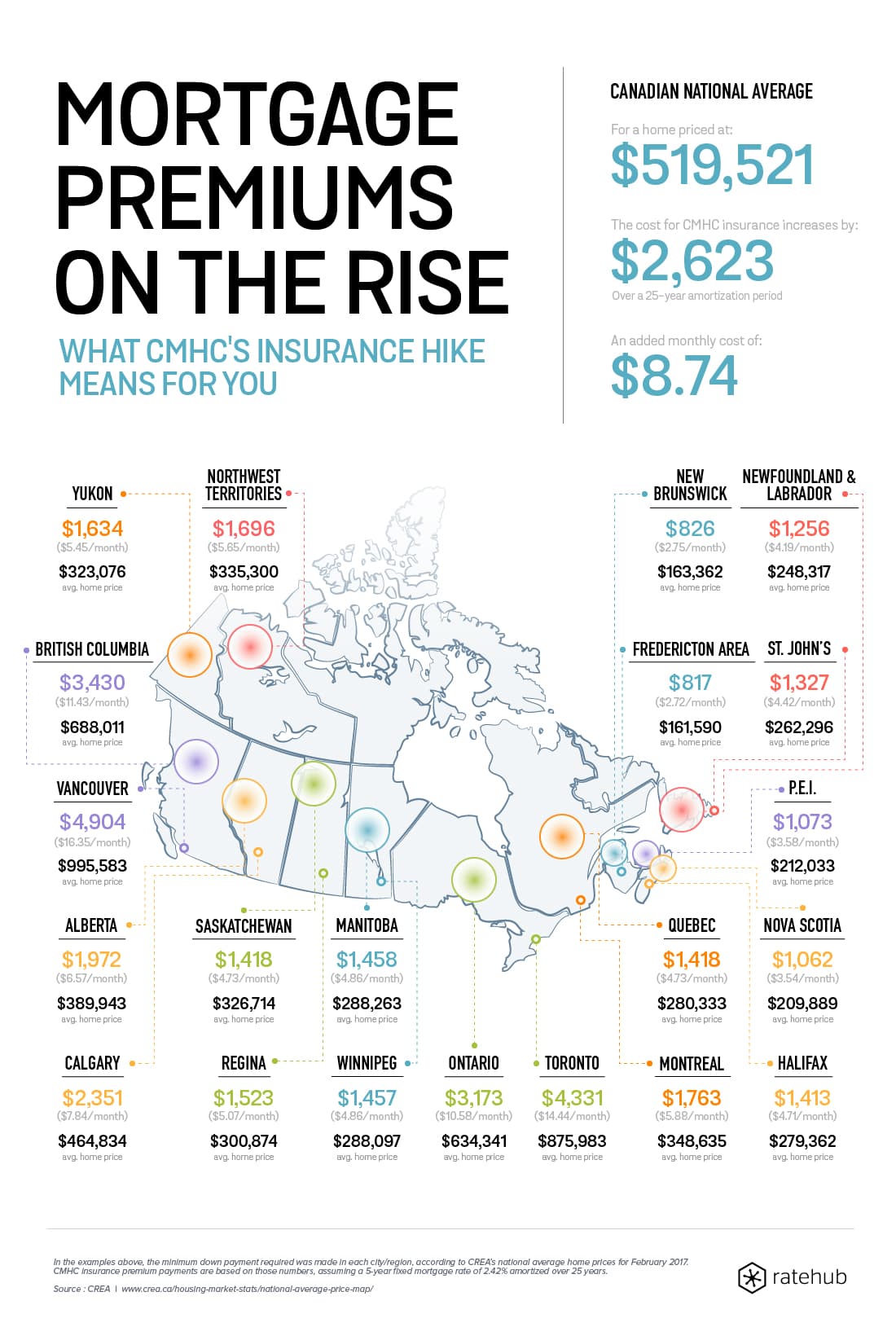

[Infographic] What CMHC’s Insurance Hike Means for New Homebuyers

Canadians who plan on purchasing a home with a down payment of less than 20% will now have to pay larger mortgage insurance premiums.

Effective today, the premium rates for new mortgage loan insurance requests submitted on or after March 17 are as follows:

Canadians with a mortgage or those who applied for one before March 17 won’t be affected by the premium increase.

For a prospective homebuyer making the minimum down payment in the Fredericton area, where the average home price was $161,590 in February 2017, the mortgage payment will increase by $2.72 a month. But in Vancouver, if a homebuyer purchases a home at the average price of $995,583 and makes the minimum down payment, the monthly mortgage payment will rise by $16.35 a month.

In the examples below, we assumed just the minimum down payment required was made in each city or province/territory based on the average home price in February 2017. The CMHC insurance premium payments are based on those numbers, assuming a five-year fixed mortgage rate of 2.42%—the best mortgage rate available as of March 16—amortized over 25 years.

Also read: