Land Transfer Tax in Toronto

In Canada, one of the largest closing costs homebuyers will face is land transfer tax (LTT). Most provinces charge LTT, but the tax rate varies from province-to-province – and in Toronto, there’s even a municipal LTT. In this blog series, we want to explain how LTT works in your province or city. In today’s post, we’ll look at land transfer tax in Toronto.

Toronto’s Land Transfer Tax

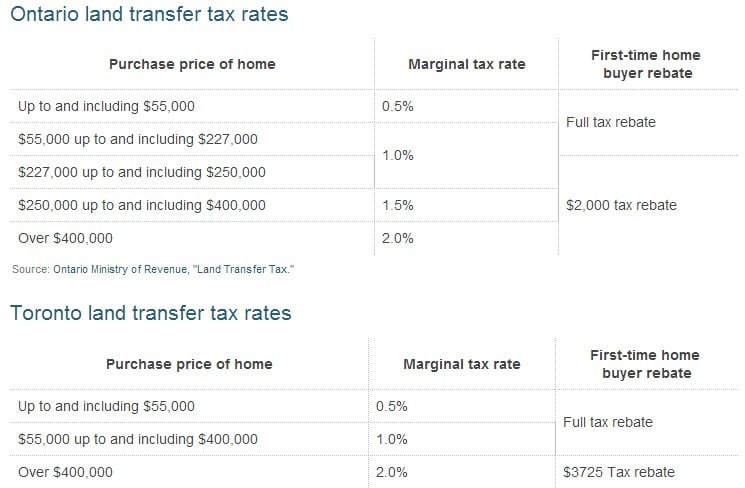

In Toronto, homebuyers are charged both the Ontario land transfer taxand the Toronto land transfer tax. The amount of tax you will have to pay is based on the purchase price of your home. Using the charts below, you can begin to see how land transfer tax is calculated in Toronto.

To calculate your land transfer tax, you take the purchase price of your home and run it through the marginal tax rates. If you’re buying a home in Toronto, this process is done twice: once for the Ontario land transfer tax and then again for the Toronto land transfer tax.

Ontario Land Transfer Tax:

- The first $55,000 of your purchase price is subject to a 0.5% tax rate ($55,000 x 0.5%)

- The amount you paid between $55,000 and $250,000 is subject to a 1.0% tax rate [($250,000 – $55,000) x 1.0%]

- The amount you paid between $250,000 and $400,000 is subject to a 1.5% tax rate [($400,000 – $250,000) x 1.5%]

- Finally, any amount you paid above $400,000 is subject to a 2.0% tax rate [(house price – $400,000) x 2%]

Toronto Land Transfer Tax:

- The first $55,000 of your purchase price is subject to a 0.5% tax rate ($55,000 x 0.5%)

- The amount you paid between $55,000 and $400,000 is subject to a 1.0% tax rate [($400,000-$55,000) x 1.0%]

- And any amount you paid above $400,000 is subject to a 2.0% tax rate [(house price – $400,000) x 2.0%]

Example Toronto Land Transfer Tax Calculation

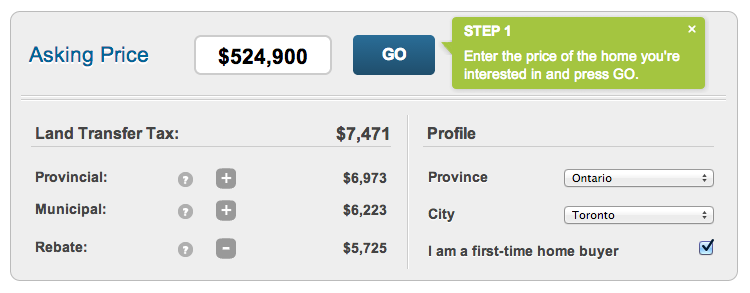

According to the Canadian Real Estate Association (CREA), the average Toronto home price is $531,374. Using a home priced close to this average, we’ll calculate how much land transfer tax a buyer in Toronto would have to pay, using our Toronto land transfer tax calculator.

The condo seen above is located in the heart of downtown Toronto – just steps from the Shangri-La Hotel – and is priced at $524,900. By entering the price into the calculator, you’ll see that the total LTT for this condo is $13,196.

To reach this figure, our calculator ran the asking price of $524,900 through the price ranges and marginal tax rates that we listed above:

Ontario Land Transfer Tax: $6,973

- The first $55,000 would cost the buyer $275 ($55,000 x 0.5%)

- The next $195,000 ($250,000 – $55,000) is another $1,950 ($195,000 x 1.0%)

- The next $150,000 ($400,000 – $250,000) is another $2,250 ($150,000 x 1.5%)

- And the last $124,900 ($524,900 – $400,000) is another $2,498 ($4,900 x 2.0%)

Toronto LTT: $6,223

- The first $55,000 would cost the buyer $275 ($55,000 x 0.5%)

- The next $345,000 ($400,000 – $55,000) would cost $3,450 ($345,000 x 1.0%)

- The remaining $124,900 ($524,900 – $400,000) would cost $2,498 ($124,900 x 2.0%)

In this example, the Ontario land transfer tax + the Toronto land transfer tax is $6,973 + $6,223 = $13,196.

Toronto Land Transfer Tax Rebates

If you are a first-time homebuyer in Toronto, you may be eligible for a rebate on both your Ontario land transfer tax and your Toronto land transfer tax. For Ontario’s land transfer tax, you can receive a maximum rebate of $2,000. For the Toronto land transfer tax, first-time homebuyers can receive a maximum rebate of $3,725.

To find out how much of a rebate you may be eligible for, simply check off the “I am a first-time home buyer” box on our Toronto land transfer tax calculator.

In this example, where the home price was $524,900, a first-time buyer could receive a land transfer tax rebate of $5,725 ($2,000 + $3,725).

When you are thinking about buying a home, it’s important that you budget for your closing costs ahead of time. As you can see, your land transfer tax can add up quickly. But if you qualify as a first-time buyer in Toronto, you may be eligible to receive a land transfer tax rebate of up to $5,725.