Ratehub.ca: 2011 Year in Review

With another year wrapped up, Ratehub.ca will take a look back at 2011 and summarize the highs, the lows, and everything in-between in regards to the Canadian mortgage industry, the Canadian housing market, and a summary of our favourite events.

Mortgage Rules

New mortgage rules took effect early in 2011 that impacted the Canadian mortgage industry by tightening the borrowing options for consumers. One of the rules reduced the maximum amortization period from 35 years to 30 years, for government-backed insured mortgages with loan-to-value ratios greater than 80%. In other words, a mortgage borrower now needs a minimum 20% down payment for their home to receive amortization lengths greater than 30 years.

This rule had an effect on the Canadian housing market as it pushed many on-the-fencefirst time home buyers into ownership for fear they would not qualify under the new rules. As a result, the extra input of first-time home buyers helped saturate the market further and create greater competition among other home buyers.

This was the third time Canada had tightened mortgage regulations in as many years. According to Canadian Mortgage Trends, the new rules in 2011 led to the following results:

- A 40% drop in insured refinances

- Greater interest expenses for consumers who could no longer refinance as much high-interest debt

- A general agreement among Canada’s leading banks to reduce their maximum amortizations to 30 years on conventional mortgages even though it was not required by the new rule changes

- Rising popularity of cash back mortgages, which simulate 90% loan-to-value refinances but cost more

Mortgage Rates

Through most of 2011, mortgage rates in Canada remained at historic lows (see chart above). For most of the year, 5-year variable rates were favourable because of the large spread between it and 5-year fixed rates. Historically, variable rates have been shown to save more money, but as the year came to a close, variable rates began to rise.This occurred while the Bank of Canada interest rate, which influences variable rates, remained untouched due to worrying global economic factors. At the same time, fixed rates started to drop, reducing the spread between the two and the advantage of the variable rate. Many lenders that were once offering big discounts to their prime rate as high as prime -0.95%, started reducing them by August. As it stands today, the Big Five now offer their published discounted 5-year variable interest rates at a premium, all of which are at prime +0.10%, or 3.10%.

What were the best mortgage rates seen on Ratehub.ca in 2011?

The best discounted 5-year fixed rate was: 3.15%

The best discounted 5-year variable rate was: 2.05%

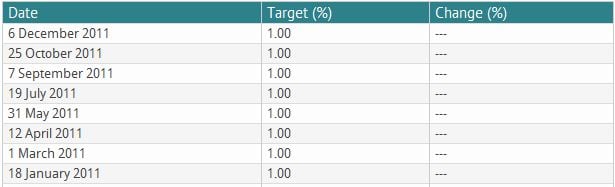

The Bank of Canada

The Bank of Canada interest rate (also known as the overnight rate) was kept untouched at 1.00% for all eight of their interest rate announcements throughout the year. With Europe (notably Greece and Italy) and the US showing poor economic growth with threats of default, the Bank of Canada chose to keep the overnight rate low to keep the Canadian economy healthy. And for the most part, it worked, although the BoC Governer, Mark Carney noticed signs of growing Canadian consumer debt hitting all-time highs (most of which was mortgage debt) and issued a few warnings. As Ratehub.ca pointed out though, Canadian mortgage debt at a record high wasn’t as big a threat to the economy as it seemed because Canadians maintained high average credit scores, had healthy home equity, and also started to rein in their debts.

Target interest rate, as set by the Bank of Canada, at key interest rate announcements in 2011

*Chart courtesy of the Bank of Canada

What do the Bank of Canada’s overnight rate predictions for 2012 look like? Based on a chart from our last Monday Mortgage Update, three of the five biggest banks in Canada expect the overnight rate to remain at 1.00% until the third quarter (Q3) of 2012. Also noted is that BMO, TD, RBC, and Scotiabank, much like many economists, expect the overnight rate to steadily climb after that period. TD and RBC economists have predicted the overnight rate will hit 2.50% by the middle of 2013.

Canadians and their Mortgages

Some startling revelations were revealed in 2011 by various mortgage polls and surveys. Here are some highlights outlined below:

- According to an RBC poll in November, 33% of Canadians aged 55 years and older still have 16+ years left on their mortgage. That means one third of older Canadians will be carrying their mortgages into their 70s

- In that same survey, younger Canadians (aged 18 to 34) had the most aggressive mortgage-free expectations for themselves, where one in four believed they would be mortgage debt-free by the age of 45

- According to a CAAMP survey, the percentage of mortgage-free home owners reached a 5-year high at 41% of Canadian home owners

- Also in the CAAMP report and sitting at 41%, is the number of people with amortization lengths greater than 25 years (10 years ago that number was at 8%)

Mortgage Rate Outlook

According to the CMHC, they forecasted the 5-year posted mortgage rate to be within 5.2% to 5.7% in 2012. Posted rates are the interest rates that lenders will publicly offer you first, but is rarely the best interest rate available.

As an example, all of the Big Five banks list their posted5-year fixed mortgage rate at 5.29%, but actually offer an average discount of 138 basis points for their special offer rates or their discounted 5-year fixed mortgage rate. Assuming the average 138 basis point discount on the CHMC interest rate projections for 2012, discounted 5-year fixed rates will fall between 3.82% to 4.32%, which is not all that dissimilar to today’s rates.

Overall, CMHC expects mortgage rates to remain relatively flat over the course of 2012. Whether interest rates actually remain at historic lows this year or start to rapidly rise, the wise mortgage shopper will always compare Canadian mortgage rates to get the best rate.

Also read: