Understanding GDS and TDS: how much can you afford?

When shopping around for a mortgage, there’s more to think about than simply finding the best mortgage rates. It’s important to also consider the terms and conditions of your mortgage, the size of your down payment, and whether or not you can afford the home—and monthly mortgage payments—you’re thinking about.

While there are handy tools like a mortgage affordability calculator to help you figure out what you can afford, it’s a good idea to understand how lenders calculate your affordability and the formulas they use to do so.

There are two standard measures of affordability lenders use to determine how much they’ll lend you. First, your Gross Debt Service Ratio (GDS) is calculated. This is the percentage of your income needed to pay all monthly housing costs: your mortgage, property taxes, heat, and 50 per cent of your condo fees (if applicable). The industry standard for GDS is 32%, meaning you typically need a GDS lower than 32% to qualify for a particular mortgage.

Next, a lender will calculate your Total Debt Service Ratio (TDS), which is similar to a GDS but also takes into account your other monthly debts, like credit card payments, car payments, alimony, and loans. The industry standard for TDS is slightly higher than GDS at 40%.

Calculating your GDS

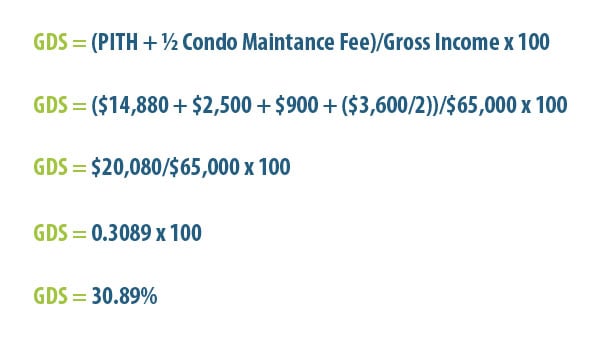

To calculate your GDS, a lender will combine your monthly housing-related costs (Principal, Interest, Property Taxes, and Heating), then divide those costs by your gross income. That figure is then multiplied by 100, resulting in your GDS percentage.

Let’s say you are in the following financial situation:

In order to calculate your GDS, you’ll want to make sure all payments are for the same time period – typically annual.

| Annual Mortgage Payments | $1,246 x 12 = $14,880 |

| Annual Maintenance Fees | $300 x 12 = $3,600 |

| Annual Property Taxes | $2,500 |

| Annual Heating Cost | $75 x 12 = $900 (industry standard) |

Once you’ve made the necessary annual calculations, you can begin to calculate your GDS.

In this scenario, your GDS falls within the acceptable industry standard of 0% to 32% so you would qualify for a mortgage with most lenders.

Calculating your TDS

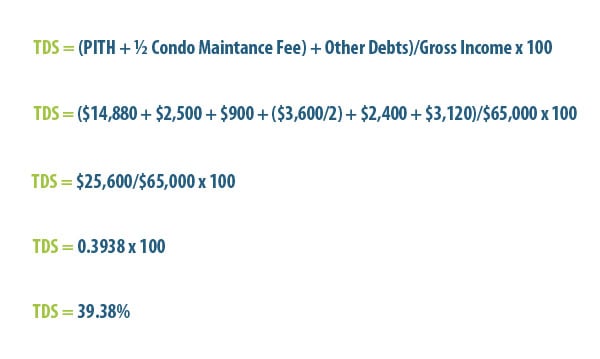

When calculating TDS, only monthly payments that are related to an existing debt are used – so things like car insurance, life insurance, or RRSP contributions are not a factor.

Let’s say that in addition to the above figures, you also have the following debts:

Again, you’ll need to convert these monthly payments to an annual amount.

| Annual Car Payment | $200 x 12 = $2,400 |

| Annual Student Loan Payment | $260 x 12 = $3,120 |

Once you’ve calculated your annual debts, you can calculate your TDS.

In this case, your TDS also falls within the industry standard of 0% to 40%, meaning you would still qualify for a mortgage with most lenders on our example condo.

What happens when I’m over the industry standard?

If your gross annual salary was lower – for instance, $62,000 – yet you were still in the same financial situation outlined above, your GDS would be 32.39% and your TDS would be 41.29%, meaning you may not qualify for a mortgage on the condo you were interested in. However, the 32% GDS and 40% TDS are simply industry guidelines, not hard and fast rules.

“If it’s a high ratio loan-to-value, then there’s really no flexibility because of external requirements, like the GDS cut-off to qualify for CMHC insurance,” said Drew Donaldson, a mortgage agent with Safebridge Financial. “However, if it’s a conventional LTV, the cut off is at the lenders discretion.”

This means if you have a high credit score, or have valuable assets (like a fully paid off car or already-owned property) you may still qualify for a mortgage even if your GDS and TDS exceeds the industry standard.

In addition, you can lower your GDS and TDS percentages by increasing your down payment, reducing your overall debt, increasing your household gross income (for instance, if you have a spouse who could go on the application), or by selecting a less expensive property.